Diversification is a technique that aims to maximize returns by investing in different areas that would each react differently to the same event. Most investment professionals agree that, although it does not guarantee against loss, diversification is the most important component of reaching long-range financial goals while minimizing risk.

1. Fact: I need to invest in companies of different size and style.

You can’t assume investing in various companies means you have a diversified portfolio. In fact, you could have quite the opposite. If you are only investing in large technology companies, then you have not diversified any risk. Large U.S. companies within the technology sector will generally rise and fall with each other over long periods of time.

The first broad differentiator for stocks is Growth vs Value. Growth stocks have a goal of growing their revenue or profits faster than the overall stock market. They are commonly found in the technology and healthcare sectors of the economy. Value stocks have a proven ability to generate profits and pay dividends, but future growth expectations are muted. Value stocks are often found in the consumer staples, utilities, financials, and telecommunication sectors.

Another broad factor to consider is company size. The size difference is commonly referred to as Small Cap, Mid Cap, and Large Cap. Large-cap stocks are widely traded, have a strong following, an abundance of company financials, independent research, and market data available for investors to review. Small-cap stocks are often short on management experience, and many of the companies still lack thorough analyst coverage. Small caps in general represent a higher-risk investment. During economic expansions, small cap stocks can outperform large caps stocks as optimism fuels smaller companies to higher workers and push forward. In the event of a recession, small cap stocks typically underperform against large-cap.

2. Fiction: I am diversified because I own multiple mutual funds.

We often see investors assuming they are diversified because they have more than one mutual fund. However, if the mutual fund objective is the same for each fund (or close to the same), the result will yield very little diversification benefit. The misstep can typically be traced back to picking mutual funds solely based on recent returns. For example, Large Cap Growth mutual funds have done very well since 2009. If you select funds based solely on recent returns, you might end up with all Large Cap Growth funds. These mutual funds own the same stocks, in slightly different percentages. ***This is a bad way to pick mutual funds. We will cover why in a separate article.

3. Fiction: I don’t need international stocks to be properly diversified.

We are told from a young age ‘Don’t keep all your eggs in one basket’. What if the basket broke? What would happen if you lost the basket? By having everything in one place you increase your risk. The same idea comes into play when you invest your money, by having everything focused in one country, you are taking on much more risk than a global approach.

There are many factors that come into play with investing around the globe, you have to worry about currency exchange, trade issues, war, and shifting political climates. These factors can work for you and against you at times. For example, the returns from international stocks can be heavily impacted by currency exchange rates. When the U.S. dollar weakens against the Euro, the earnings from European companies translates into more dollars, which helps international returns. Vice versa, a strong dollar can hurt returns on international stocks. This gets back to the purpose of diversification and the power of compound interest.

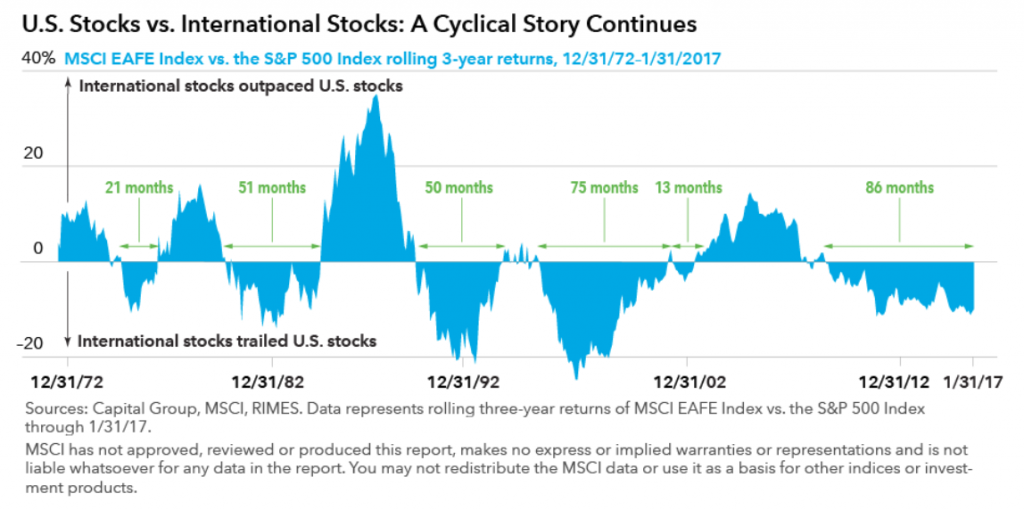

The chart below shows periods of outperformance by either U.S. or International Stocks.

4. Fiction: I am diversified because I have multiple accounts

This happens more than you would think. There are two common misjudgments:

The belief you are diversified by using multiple financial institutions / banks.

While using different financial institutions might change your universe for investment selection, your options will greatly overlap. Fierce competition in the mutual fund industry has caused most investment managers to cut costs, which has resulted in undifferentiated offerings. The title/brand of the mutual fund might be different, but the strategy and holdings are probably not unique. Not to mention, investment risk is not insured against market loss, unlike bank products where spreading it around might lead to a higher FDIC insurance limit.

The belief you are diversified because you have different types of investment accounts (IRA, Roth IRA, 401(k), etc.).

The account type is simply the wrapper. Your investment selection within the account should be unique to it’s expected time horizon (how long before you start withdrawals). This is not to say that having different types of accounts does not help to diversify your portfolio for tax purposes. Having a Traditional IRA and a Roth IRA will help your tax diversification. Having different tax advantaged accounts can help you manage your taxable income during retirement. However, even with different tax advantaged accounts, you need to make sure the investments inside of them are diversified and the risk aligns with your expected time horizon for making withdrawals.

2 Schools of Investing: Growth vs. Value

The Importance Of Diversification

Here’s Why You Shouldn’t Give Up on International Stocks