We often have people ask us questions such as: “Where is a good place to get started investing? What will give me the best return?” Or “I have $1,000 to invest, where should I put it?” The reality for questions like these is the return for the investment does not matter as much when you are just starting to invest. Don’t get me wrong you want the best return, but in the beginning saving is more important. Saving has a larger impact when you are just starting, than what you are investing in.

To use an example:

“Let’s say you save up $1,000 and put it into an ETF with an expectation of getting a 10% annual return ($100). You could spend your entire annual return in 1 night going out with friends. Dinner + drinks + transportation and it’s gone. However most of us would be able to save an extra $100 through the year.”

On the other hand, when you look at a balance of $1,000,000 a 10% return would be $100,000. Now try spending that all on a night out with friends and that would be one hell of a night. On a more serious note, many people could not save $100,000 in a year. Even if they tried, one would need to have a very significant income to get close to saving $100,000.

Savings has a much greater impact the smaller your account is; in turn your investment returns have a much greater impact the larger your account.

Let’s look at an example of this played out over Jeff’s lifetime. Assume Jeff invests over a 40 year investment time frame. Jeff makes $50,000 a year and saves 15% annually (i.e. you save $7,500 each year for 40 years). Additionally, we will assume that you get a 5% annual return on your money with a 9% standard deviation(which simply means the year-to-year return will vary, but will average an annual 5% over time).

In year 1, Jeff saves $7,500 and gets no investment return on it. In year 2, Jeff gets some investment return (random but averages 5%) on the original $7,500 he saved, and he saves another $7,500. In year 3, Jeff gets another random return on the money he had at the end of year 2, and Jeff saves another $7,500. This continues onward for 40 years.

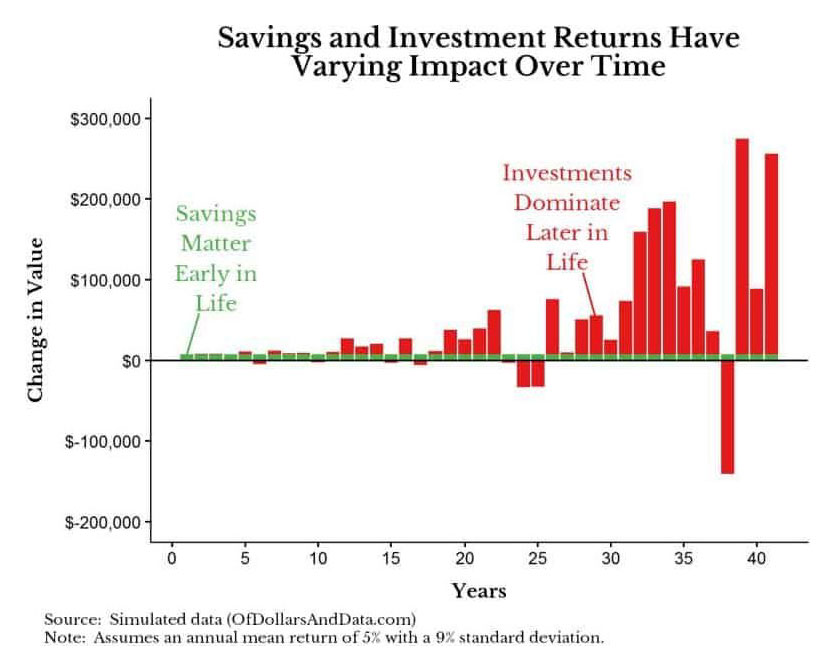

The graph below shows how much Jeff saved in each year (green bar) versus how much he gained/loss from investments in each year (red bar) it could look something like this:

As you can see, the green bars are constant over time since Jeff always saves $7,500, but the red bars fluctuate as Jeff’s investment returns fluctuate. Additionally, early in Jeff’s investment life his savings are much larger than investment returns as he would have very little assets. However, as he gains more assets, his gain (or loss) from these assets has a much larger impact on his finances.

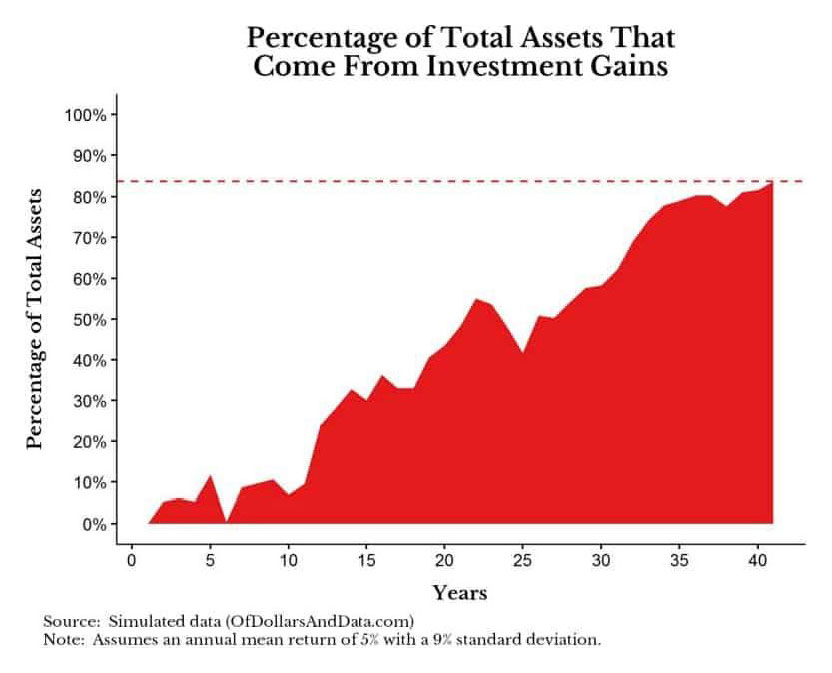

By the end of the 40 years, Jeff would have saved $300,000 ($7,500 * 40 years), but he would have gained ~$1.6 million from investments. This $1.6 million represents 84% of the total assets in year 40 with the $300,000 saved representing the other 16%. On a chart that would look like this:

The main point of any of this is that you should focus on savings over time. Building wealth starts with a small investment, and the investment return will start to matter more over time. In the beginning, the return will not be as significant as the amount you save. As wealth builds over time, you will see your return play a greater role in the growth of your investments. But none of it will ever happen without starting. It might seem like you are not getting anywhere and your only real gain is from your own contributions, but investing is a long-term game. Over time, the number will begin to compound and add up.