We assume in this article that the accounts have similar tax treatment and registration. In the event, accounts do not have the same account type and registration, the process of moving money becomes more complex. We will not address those situations in this article. If you have questions regarding those please reach out to your advisor.

Retirement account owners often decide to move their accounts from one retirement account to another. One example of this is when an employee leaves or retires from an employer with a 401k plan. That employee may choose to move their 401k funds into an IRA account. Another example would be an IRA account owner may choose to move their IRA account from one custodian(Company holding the account) to another, for example, Charles Schwab to TD Ameritrade. These movements can be broken down into two categories, indirect and direct movement.

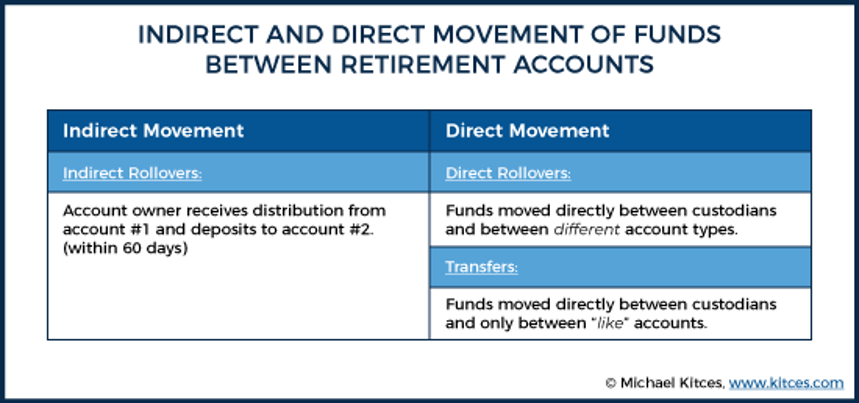

The basic idea behind these movements is that money is being moved from one account to another. The graphic below breaks down the difference between indirect and direct movement. It also shows the difference between a rollover and a transfer.

‘Direct’ refers to the way the money moves between the two institutions where the accounts are held, directly. To be a direct movement the money must not leave ownership of the custodian. Meaning the money in the account never goes to the account holder, it stays in the account.

There are two types of direct movements, rollovers and transfers. There are a few differences between the two, one is based on the type of accounts the money is being moved between. Another difference is that a rollover gets reported on your tax return and a transfer does not.

A Rollover is when funds are directly moved from one custodian to another between different types of accounts. Let us look at an example of a rollover when a 401k held at Fidelity is moved to an IRA held at TD Ameritrade.

Example One

Jerry Smith has just retired from Company ABC, he has a 401k worth $1,000,000 held at Fidelity. He would like to move the money into a Traditional IRA at TD Ameritrade. Let us assume the money is all pre-tax. Jerry does not want to take any money out of the account and he does not want to have to pay any taxes as a result of the transfer.

Jerry is going to implement a direct rollover. He is going to reach out to his 401k provider and have them cut a check for the full $1,000,000 and make it payable to TD Ameritrade FBO(for the benefit of) Jerry Smith. Since Fidelity made the check out to TD Ameritrade FBO Jerry Smith, Jerry never actually received any money from the movement. It went directly from Fidelity to TD Ameritrade.

The scenario above is a Direct Rollover since the money is moving directly from one custodian to another with different types of accounts. This type of movement is required to be reported on your tax return for that year. In the example above, Fidelity would generate a 1099-R showing the amount of the 401k leaving as a rollover. The 1099R is simply a paper-trail to show the account left Fidelity and arrived at TD Ameritrade. Jerry would not owe taxes on this movement but he still must report that it took place since the account type changed.

The other type of direct movement would be a transfer. A Transfer is when funds move directly from one custodian to another, between like accounts. Let us look at an example of a transfer.

Example Two

Jerry has a Traditional IRA at Fidelity and he would like to move it to TD Ameritrade. Jerry does not want to pay taxes or have to report the movement on his taxes. To achieve his goal he is going to move the account with a direct transfer.

Jerry will first establish a Traditional IRA at TD Ameritrade. He will then fill out TD Ameritrade’s Transfer Paper to start the process of moving his account from Fidelity to TD Ameritrade. Once the process is complete Jerry’s account will have moved directly from Fidelity to his new account at TD Ameritrade.

In the example above, there are a few key differences in the transfer process from the rollover process. In the rollover example, Fidelity had to cut a check for the account balance, in a transfer the account does not have to be liquidated to be moved. Since the account does not have to be liquidated, once Jerry submits the transfer paperwork needed to TD Ameritrade, the entire transfer is taken care of between Fidelity and TD Ameritrade. Jerry does not have to worry about receiving a check and depositing it. This type of movement does not have to be reported on your tax return since the type of account is not changing.

Indirect movements are transactions where a retirement account owner receives a distribution from their account, that they intend to subsequently re-contribute to account within 60-days. If the funds are not put in another account the account owner is subject to pay taxes on the amount of the distribution. We are going to show what this would look like using the two examples from above.

In Example One:

What if Jerry had had Fidelity make the $1,000,000 check payable to himself rather than TD Ameritrade? Well, first Jerry is probably not going to get a check for $1,000,000 he will receive a check for $800,000. The reason is distributions made from 401(k), 403(b), and similar employer plans are generally subject to mandatory withholding of 20% for Federal income taxes, this is not always the case but is common practice.

Notice how Fidelity treated Jerry’s request as a distribution, not a rollover. Since Jerry did not specify that the check be made payable to another custodian, Fidelity has to treat the transaction as a distribution from the plan. This movement does not actually become an indirect rollover until Jerry puts the money into his IRA account at TD Ameritrade, which he has to do within 60 days.

Jerry has a problem, Fidelity only paid him out $800,000 they sent the other $200,000 in his account to the IRS. Jerry can put the $800,000 into his IRA account, but what does he do about the other $200,000. Well, Jerry has to come up with $200,000 to put into his IRA within 60 days or he will owe taxes on it.

Let’s assume Jerry happens to have $200,000 in savings, and he uses that money to fund his IRA up to $1,000,000. When Jerry files his taxes that year he can expect to get a $200,000 return.

If Jerry did not have a spare $200,000, then he could only report a $800,000 as the amount he rolled over and he will owe taxes on a $200,000 distribution plus any penalties.

By Fidelity making the check payable to TD Ameritrade directly Jerry could have avoided a potential major tax bill and headache. Whether Jerry gets the full $1,000,000 or just $800,000 into his IRA Fidelity will generate an 1099-R and Jerry will have to report this movement on his tax return.

In Example Two:

What if Jerry moved the money out of his Fidelity IRA into his bank account then deposited it into his TD Ameritrade IRA? If Jerry takes $100,000 out of his Fidelity IRA and puts that money in his bank account. He now has $100,000, there is no a 20% withholding when taking money out of an IRA account. In order for Jerry to not owe taxes and penalties on the $100,000 distribution, he will need to put the full amount back into an IRA within 60 days.

Since Jerry has the full $100,000 all he would have to do is deposit the funds into his IRA at TD Ameritrade. Once he puts the full amount back into an IRA within 60 days he will not owe taxes on the indirect rollover. However, he will have to report the movement on his return and show that it left his IRA and went into another IRA within 60 days.

Now even though there is not a 20% withholding on this type of indirect rollover there are other restrictions. You are only allowed to make one of these types of indirect transfers every 365 days, per person. To the extent Jerry still tries to make another indirect rollover during the one-year period, when not permitted to, it is considered an excess contribution to the new account and is subject to a 6% excess contribution penalty for each year it remains in the IRA without being corrected.

In summary, direct movements in addition to removing the 60-day time limit to complete an indirect rollover, moving retirement money directly from one retirement account to another also eliminates other inconveniences that are inherent with indirect rollovers.

For instance, both direct rollovers and transfers allow a retirement account owner to avoid mandatory Federal tax withholdings when moving retirement funds between accounts. Similarly, there are no limits on the number of times that an individual can complete a Direct Rollover or Transfer each year.The various benefits associated with Direct movements of retirement dollars makes it the preferable option in all but the rarest of circumstances.