The Roth IRA has become a popular retirement savings account, and for good reason. Besides being easy to open and fund, contributions are invested and grow tax free until withdrawal in retirement1. Who doesn’t like tax free, right? While most people have heard of the tax free potential of a Roth IRA, there are additional benefits to consider in your retirement plan.

Here are five reasons beyond the tax-free growth and withdrawals for using a Roth IRA:

1. Minimization of Social Security Taxation and Medicare Surcharges

You may not be aware, but the taxation of Social Security benefits and cost of your Medicare premiums is directly related to your income in retirement.

Social Security income is either tax free, partially taxable, or mostly taxable. The level of taxation applicable to Social Security income depends on the make-up of your household income. Your other sources of taxable income from wages, pensions, and/or IRA/401(k) withdrawals will influence the taxation of Social Security. Having access to a Roth IRA for tax free withdrawals can help you with a tax efficient retirement plan by preventing or reducing tax on your Social Security benefits2.

Combined Income & Social Security Taxation

| Single, Head of Household and Widow | Married Filing Jointly | Social Security Taxation |

|---|---|---|

| Under $25,000 | Under $32,000 | 0% of Social Security taxed |

| Between $25,000 - $34,000 | Between $32,000 - $44,000 | Up to 50% of Social Security taxed |

| More than $34,000 | More than $44,000 | Up to 85% of Social Security taxed |

| 2https://www.ssa.gov/benefits/retirement/planner/taxes.html | ||

As far as Medicare goes, the Social Security Administration adds a surcharge to Medicare Part B and D premiums for “high income earners.” Like with the tax rates, this surcharge, also known as Income-Related Monthly Adjustment Amount4 (IRMAA), is determined by a tiered schedule. Again, the combined total of your taxable income sources can lead to a higher Medicare premium. While they call it a ‘monthly adjustment’, we call it a tax. The availability of a Roth IRA to supplement income can help you stay below these important thresholds.

Medicare 2024 Part B Premiums By Income

If your filing status and yearly income in 2022 was:File Individual Tax Return | File Joint Tax Return |

|

|

|---|---|---|---|

| Less than or equal to $103,000 | Less than or equal to $206,000 | $0.00 | $174.70 |

| Greater than $103,000 and less than or equal to $129,000 | Greater than $206,000 and less than or equal to $258,000 | $69.90 | $244.60 |

| Greater than $129,000 and less than or equal to $161,000 | Greater than $258,000 and less than or equal to $322,000 | $174.70 | $349.40 |

| Greater than $161,000 and less than or equal to $193,000 | Greater than $322,000 and less than or equal to $386,000 | $279.50 | $454.20 |

| Greater than $193,000 and less than or equal to $500,000 | Greater than $386,000 and less than or equal to $750,000 | $384.30 | $559.00 |

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $419.30 | $594.00 |

| 3https://www.medicare.gov/Pubs/pdf/11579-medicare-costs.pdf | |||

Having a Roth IRA to draw from in retirement helps minimize taxable income for both Social Security and Medicare purposes. Because Social Security’s income thresholds are so low, it’s hard to avoid taxation completely, but Roth IRAs can possibly keep you at the 50% rate rather than at 85%. IRMAA thresholds are easier to work with. Using a Roth IRA to supplement other income could make the difference between having a Medicare surcharge and avoiding one.

2. No Required Minimum Distributions

Unlike in pre-tax retirement accounts such as 401(k)s and Traditional IRAs, Roth IRA withdrawals are not subject to income taxes. The purpose of Required Minimum Distributions (RMDs) is to force you to take annual withdrawals from your pre-tax accounts by a certain age, so you can start paying the respective tax on that money. Currently that age is 73, though that is subject to change. Without that RMD necessity, Roth IRAs give you more flexibility in retirement. Retired and comfortable living off of Social Security or other income? That’s fine–you can leave the Roth money in the account as long as you like. When you do need it, you can withdraw as much or as little as you like–without having to pay taxes on it.

3. Lower Tax Rates

Staying on the theme of taxes, because withdrawals from Roth IRAs are tax-free, and don’t count towards taxable income (as a distribution from a Traditional IRA would), you don’t have to worry about the withdrawals pushing you into a higher income tax bracket in retirement. Incidentally, federal tax rates are at pretty low levels historically, and will probably rise in the future. If you are worried about rising tax rates or the U.S. national deficit, having a Roth IRA can help hedge against these risks.

4. Inheritance Benefits

Beneficiaries of Roth IRAs receive their inheritances tax-free. And the tax-free treatment of withdrawals that the original owner was allowed flows through to beneficiaries when they withdraw from the account. The Inherited Roth IRA is subject to Required Minimum Distributions, although no taxes are due on these RMDs if the account has been around for at least five years. If you are concerned about legacy wealth planning and your beneficiaries are in a higher tax bracket than you, focusing on Roth IRA will benefit your estate plan.

5. Minimization of Capital Gains

Many people have brokerage accounts, which are investment accounts not specifically earmarked for retirement. If invested well, a brokerage account accumulates some nice growth and can be used for retirement income as well as short-term needs. Like with a Roth IRA, contributions to brokerage accounts are made with after-tax dollars, so principal withdrawals are tax-free. However, earnings (growth) in brokerage accounts do not enjoy the tax-free status that earnings in Roth accounts have. Any income produced by brokerage accounts, whether from dividends or sales of appreciated assets, is subject to capital gains tax.

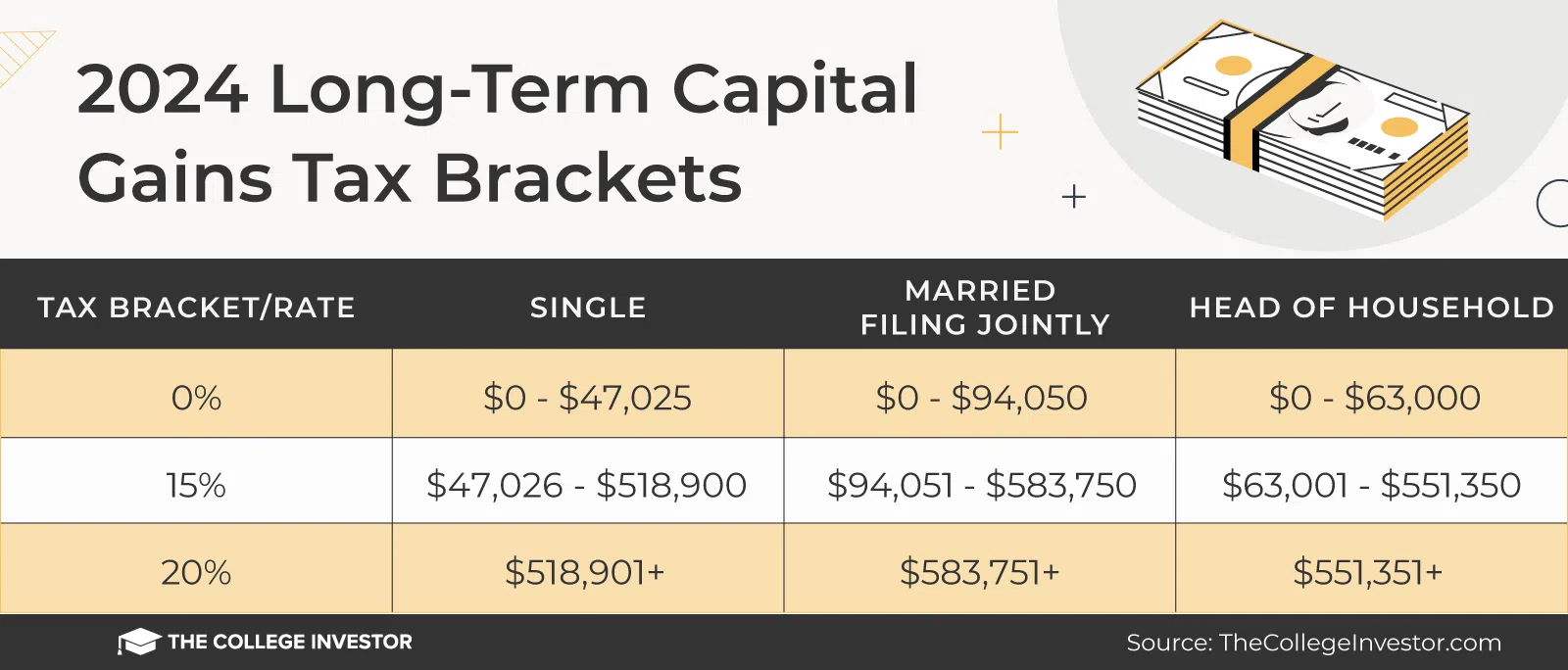

The income thresholds and tax brackets for capital gains are different from ordinary income, and it’s still possible to avoid capital gains tax altogether, but you have to be strategic. In 2024, you can remain at the 0% capital gains rate5 if your taxable income (which is defined as total income minus the standard or itemized deduction) is less than $47,025 if filing single, and $94,050 if married filing jointly. This is much easier to do if you can spread out your withdrawals between different types of accounts.

For example, a retiree who hasn’t yet collected Social Security or started RMDs – in other words, someone with little taxable income in a given year – can withdraw quite a bit from a combination of a Roth IRA, a Traditional IRA, and/or a brokerage account without incurring any capital gains taxes.

Tax strategies such as this can really help retirees make their investment accounts work for them. And a Roth IRA plays a big part. While the Roth works best for people with long time horizons, who can take advantage of the power of compounding, it may also be a great addition for people further along the path to retirement, who also see tax rates rising for them in the future, and would like another savings vehicle.