Target date funds have become the dominant investment solution for employer sponsored retirement plans (401(k), 403(b), etc). In recent years, 401(k) plans have gone as far as offering them as the only investment solution available to you. So what’s the deal? Is this a good or bad thing for retirement investors? Well, we think it depends, and we would like to make you more aware of the pros and cons.

What is a target date fund?

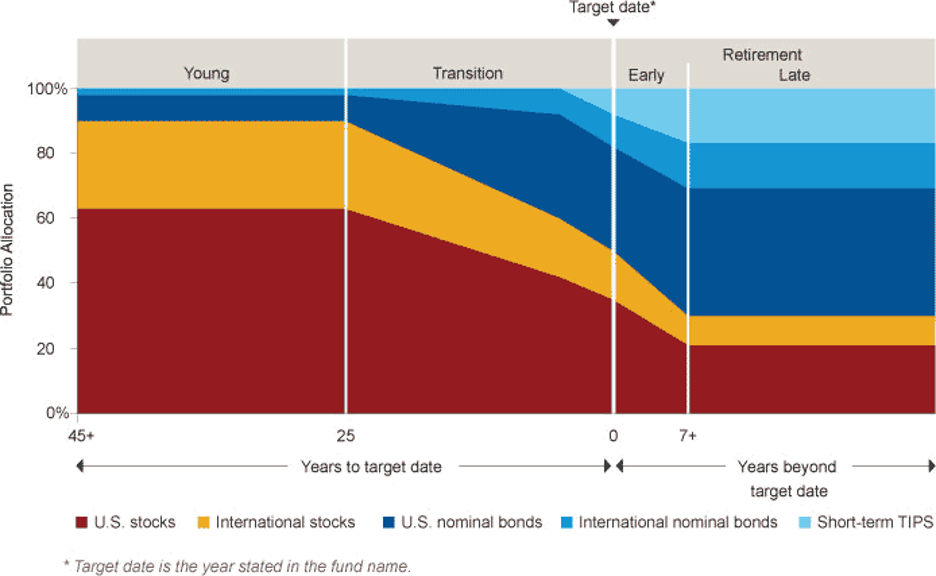

A target date fund is a mutual fund that gradually gets more conservative as you get closer to the targeted date. For example, if I plan to retire at 65 years old in the year 2050, I would select the Target Date 2050 fund. The further away from the targeted date, the fund is generally more aggressive by allocating more of the portfolio to stocks. While both stocks and bonds have risk, stocks are perceived as generally riskier investments with higher growth potential. Bonds, on the other hand, are perceived as generally safer investments and are more heavily relied upon for preserving wealth and managing withdrawals during retirement.

Theoretically, the mechanics of a target date fund make logical sense, but in practice, there are some clear pros and cons you should be aware of.

Pros

Put simply, target date funds are easy, process-driven, and usually cheap. Especially with the lack of financial literacy in the U.S., an ‘easy button’ can be helpful for an investor who otherwise might not have an investment strategy. While there’s no such thing as a perfect investment strategy, having a defined process for investing is usually a good thing. Target date funds make it easy to select an all-in-one solution that has your retirement timeline in mind. We find investors are less likely to make irrational decisions with their investments when they believe there is a purpose or strategy behind their investment approach. If they selected the mutual funds themselves, with little confidence and purpose, it’s common for investors to make changes at the worst possible times.

Lastly, fees matter. Target date funds made up of index funds are generally very cheap compared to average mutual fund fees1. While not all target date funds are cheap, we find that most target date funds offered inside 401(k) plans have at least reasonable fees. To check for yourself, view the expense ratio of the mutual fund. We’d generally like to see the expense ratio less than 0.5%.

Cons

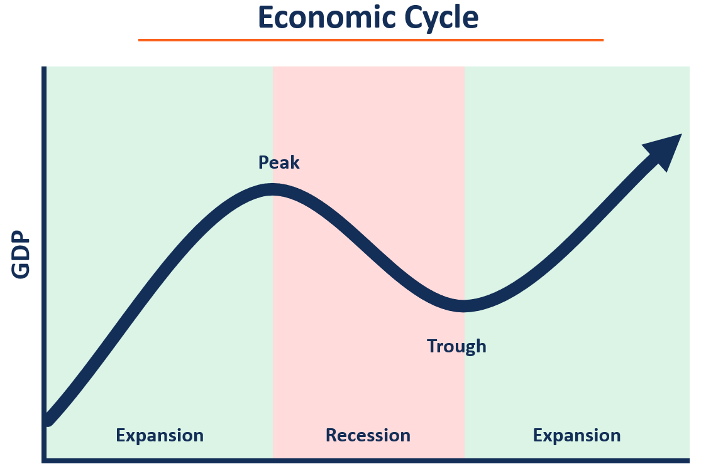

Target date funds can be overly mechanical and impersonal. We agree that a sound investment strategy should involve gradually becoming more conservative as you age; however, the forced shift from stocks to bonds every year ignores the cyclical nature of the stock market. If you have even the slightest investment experience or knowledge, you understand our economy runs in cycles of expansion and recession. Luckily, the expansions generally last longer than recessions because human innovation and progress has taken us a long way over the last few hundred years.

The mechanics of a target date fund work against you during recessionary periods. In the stock market, we call an expansion a bull market and a recession a bear market. According to the National Bureau of Economic Research (NEBR)2, the average U.S. bull market lasts 51 months and averages +152% growth. The average U.S. bear market lasts 20 months and averages a -40% decline.

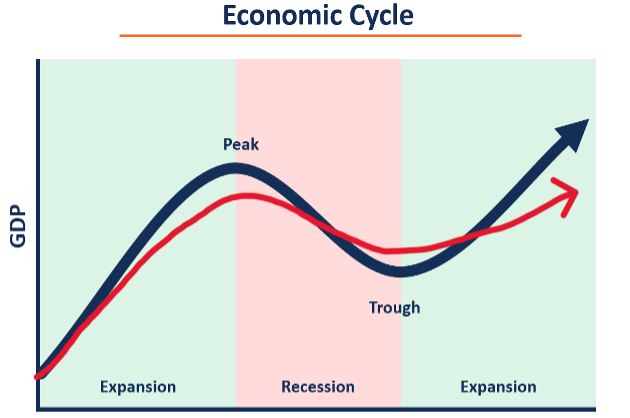

During a bull market, a target date fund is gradually becoming more conservative and preventing your full participation in the growth. At the onset of a recession, you begin the bear market in a portfolio with a larger allocation to stocks and in-turn participate more in the start of the market downturn. During the bear market, your portfolio becomes more conservative, possibly preventing further pain during the decline, but also preventing your ability to recover. The chart below illustrates the effects of a target date fund during a market cycle. In general, it takes longer to reach your breakeven point in a target date fund. We find this flaw especially difficult when it’s encountered right before you retire.

We see the greatest risk of target date funds being their misalignment with your personal goals and risk tolerance. Every household has a different financial make-up and set of goals. It’s easy for a target date fund to be used inappropriately in a financial plan. While there are countless scenarios, a simple and common example is a 50-year old individual that is behind on retirement savings and needs maximum growth potential. Ideally, they would still like to retire by 65 years old. If they select the 2040 Target Date fund, they will be invested in a moderate portfolio with limited and decreasing growth potential. Can they still hit their goals? Maybe. But it’s like using a screwdriver vs. an electric drill to get the job done. There are simply better alternatives that can help you get back on track.

Target date funds can be a great way to maneuver an investing world that can be overly complex and confusing, but investing for your specific wants and needs will often require a more personally catered approach than target funds can offer. Consult with a trusted financial planner who can help you decide what kind of investment strategy you need to implement.

- https://time.com/personal-finance/article/what-are-expense-ratios

- Source: FactSet, NBER, Robert Shiller, Standard & Poor’s, J.P. Morgan Asset Management.* A bear market is defined as a 20% or more decline from the previous market high. The related market return is the peak to trough return over the cycle. Periods of “Recession” are defined using NBER business cycle dates. “Commodity spikes” are defined as movement in oil prices of over 100% over an 18-month period. Periods of “Extreme Valuations” are those where S&P 500 last 12-months P/E levels were approximately two standard deviations above long-run averages, or time periods where equity market valuations appeared expensive given the broader macroeconomic environment. “Aggressive Fed Tightening” is defined as Federal Reserve monetary tightening that was unexpected and/or significant in magnitude. Bear and bull returns are price returns.Guide to the Markets – U.S. Data are as of December 31, 2023.

- https://www.putnam.com/advisor/content/perspectives/8014-economic-expansions-and-equity-returns

- https://institutional.vanguard.com/investment/strategies/tdf-glide-path.html

- https://www.fidelity.com/learning-center/personal-finance/what-is-a-target-date-fund